The market of municipal sanitation vehicles in the first half of 2025: The penetration rate of new energy has soared, and intelligence has become the key to breaking the situation.

05-30-2025 20:01

Quick Look at the Core Data

Total sales volume: 85,000 vehicles, with a year-on-year growth of 15%.

Total sales volume: 85,000 vehicles, with a year-on-year growth of 15%.

New energy vehicle sales volume: 18,700 vehicles, with a year-on-year increase of 86% and a penetration rate of 22% (compared with 12% in the same period of 2024).

Concentration degree of leading companies: The CR3 (the combined market share of the top three companies) reached 58%. Zoomlion, Chengli Special Automobile, and Hubei Kaili have firmly occupied the top three positions.

Popular models: The sales volume of new energy washing and sweeping vehicles was 7,200 units, exceeding that of fuel vehicles for the first time and accounting for 60%.

New Energy Storm Sweeping the Industry: Driven by Both Policies and the Market

(2) Cross-border Cooperation Reshaping the Competition Pattern

Traditional automobile enterprises and technology companies are accelerating their integration. Dongfeng Motor and Baidu Apollo jointly developed L4-level autonomous driving sanitation vehicles, with plans for mass production by the end of the year. DJI Agriculture launched an integrated unmanned vehicle combining "sweeping and spraying" functions, which has been tested in scenic spots in Guangzhou. The 5G + Beidou positioning system jointly developed by Huawei and Yutong has increased the dispatch efficiency of sanitation vehicles in Zhengzhou by 30%.

Traditional automobile enterprises and technology companies are accelerating their integration. Dongfeng Motor and Baidu Apollo jointly developed L4-level autonomous driving sanitation vehicles, with plans for mass production by the end of the year. DJI Agriculture launched an integrated unmanned vehicle combining "sweeping and spraying" functions, which has been tested in scenic spots in Guangzhou. The 5G + Beidou positioning system jointly developed by Huawei and Yutong has increased the dispatch efficiency of sanitation vehicles in Zhengzhou by 30%.

The market competition is white-hot: The leading effect is prominent, and model innovation breaks the deadlock.

(1) CR3 Reaches 58%, and the Concentration Degree Hits a New High Again

Zoomlion firmly ranks first with a market share of 25%. Its new energy products cover the entire range of models, and its market share in the washing and sweeping vehicle market exceeds 40%. Chengli Special Automobile, relying on the industrial cluster in Suizhou, Hubei Province, ranks second with an 18% share. Its green spraying vehicles and lightweight garbage trucks have obvious advantages in the county-level market. Hubei Kaili ranks third with a 15% share, and its compressed garbage trucks have a market share of over 35% in Central China.

Zoomlion firmly ranks first with a market share of 25%. Its new energy products cover the entire range of models, and its market share in the washing and sweeping vehicle market exceeds 40%. Chengli Special Automobile, relying on the industrial cluster in Suizhou, Hubei Province, ranks second with an 18% share. Its green spraying vehicles and lightweight garbage trucks have obvious advantages in the county-level market. Hubei Kaili ranks third with a 15% share, and its compressed garbage trucks have a market share of over 35% in Central China.

(2) Cost and Model Innovation Become the Key

Faced with the high purchase cost of new energy models (30% - 50% higher than that of fuel vehicles), enterprises have successively launched innovative solutions. Yinfeng Environment has adopted an integrated "vehicle + station + electricity" model to provide financial leasing services for customers. Chengli Special Automobile has reduced the cost of new energy washing and sweeping vehicles by 15% through large-scale production. Suizhou, Hubei Province has set up an industrial fund of 500 million yuan to support enterprises in researching and developing cutting-edge technologies such as hydrogen energy and autonomous driving, aiming to build itself into the "Capital of Intelligent Sanitation Vehicles in China".

Faced with the high purchase cost of new energy models (30% - 50% higher than that of fuel vehicles), enterprises have successively launched innovative solutions. Yinfeng Environment has adopted an integrated "vehicle + station + electricity" model to provide financial leasing services for customers. Chengli Special Automobile has reduced the cost of new energy washing and sweeping vehicles by 15% through large-scale production. Suizhou, Hubei Province has set up an industrial fund of 500 million yuan to support enterprises in researching and developing cutting-edge technologies such as hydrogen energy and autonomous driving, aiming to build itself into the "Capital of Intelligent Sanitation Vehicles in China".

Challenges and Outlook for the Second Half of the Year

(1) Three Bottlenecks to Be Broken Through

Insufficient charging infrastructure: The coverage rate of special charging stations for sanitation vehicles across the country is only 30%, and the problem of difficult charging in winter is particularly prominent in northern regions.

Insufficient charging infrastructure: The coverage rate of special charging stations for sanitation vehicles across the country is only 30%, and the problem of difficult charging in winter is particularly prominent in northern regions.

Weakness in low-temperature technology: The endurance of lithium batteries decays by more than 40% in an environment of -20°C, restricting the market promotion in Northeast and Northwest China.

Local financial pressure: The procurement budgets of some county-level regions are limited, and the promotion of new energy models relies on financial innovation.

(2) Trend Forecast for the Second Half of the Year

Sales volume sprint: The annual sales volume is expected to exceed 180,000 vehicles, and the penetration rate of new energy may reach 25%.

Sales volume sprint: The annual sales volume is expected to exceed 180,000 vehicles, and the penetration rate of new energy may reach 25%.

Technology route: The battery swapping mode will be popularized in the field of heavy-duty vehicles, and 800V high-voltage fast charging will become the mainstream.

Regional battlefield: County-level regions in western China and the Yangtze River Delta urban agglomeration will become the key areas for the "double pilot" of new energy and intelligent equipment.

Conclusion: In the first half of 2025, the municipal sanitation vehicle market is using new energy as the "background color" and intelligence as the "paintbrush" to outline a new picture of industrial transformation. When "green" becomes a necessity and "intelligent" becomes a standard feature, this industrial upgrade driven by policies, technologies and the market is not only related to urban cleanliness but also heralds the rise of a trillion-level "intelligent sanitation" new ecosystem.

(The data in this article are synthesized from the China Association of Automobile Manufacturers, the financial reports of various enterprises and public information, and some are industry forecasts.)

RELATED NEWS

Like Us

-

Mixer Supporting Wheel Testing Machine

Mixer Supporting Wheel Testing Machine

-

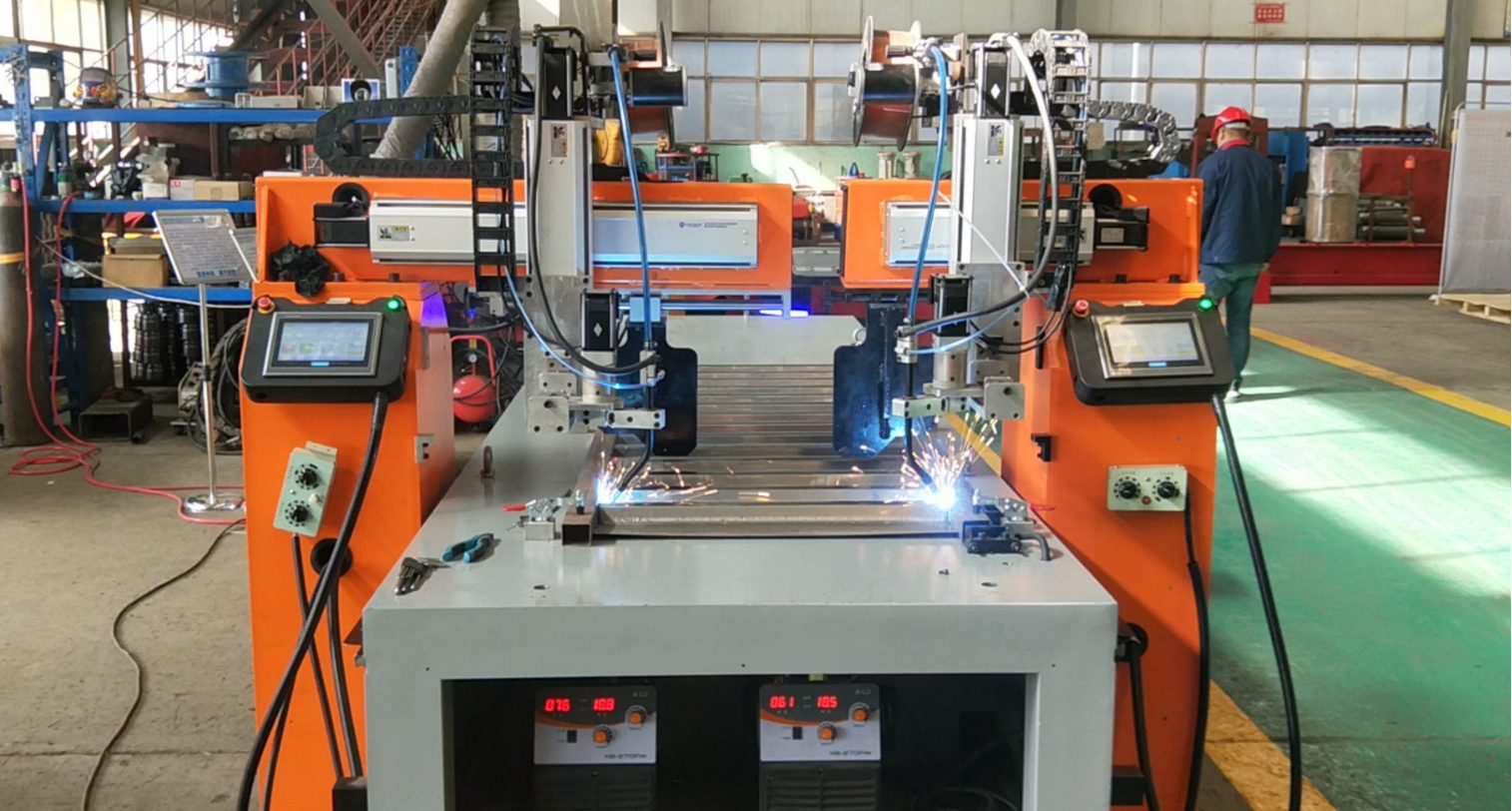

Intelligent double wire girth automatic welding machine

Intelligent double wire girth automatic welding machine

-

Tank Automatic Tig Welding Machine

Tank Automatic Tig Welding Machine

-

Compartments board intelligent welding robot

Compartments board intelligent welding robot

-

Automatic Flat Board Turnover Machine

Automatic Flat Board Turnover Machine

-

No Template Irrgeular Dished Head Folding Machine

No Template Irrgeular Dished Head Folding Machine

-

Automatic Paint-Spraying Booth Product

Automatic Paint-Spraying Booth Product

-

Horizontal corrugated plate welding equipment

Horizontal corrugated plate welding equipment

-

Traction Module Collaboration Workstation

Traction Module Collaboration Workstation

-

Automatic axle welding machine

Automatic axle welding machine

Mobile: 0086 159 0547 0098

Email: shuai@shuipo.com

Add: Industrial Park(NO.16,National highway 220),Quanpu Town, Liangshan County, Jining City, Shandong Province, China.

Post code: 272613